Money in your savings account is considered cash, while the funds in your money market accounts or government bonds are cash equivalents. The personal cash flow template is a very simple and straightforward template to use to manage your household budget. If you have a hard time with this or simply don’t have the time, then no worry. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances.

Rise above the spreadsheet chaos

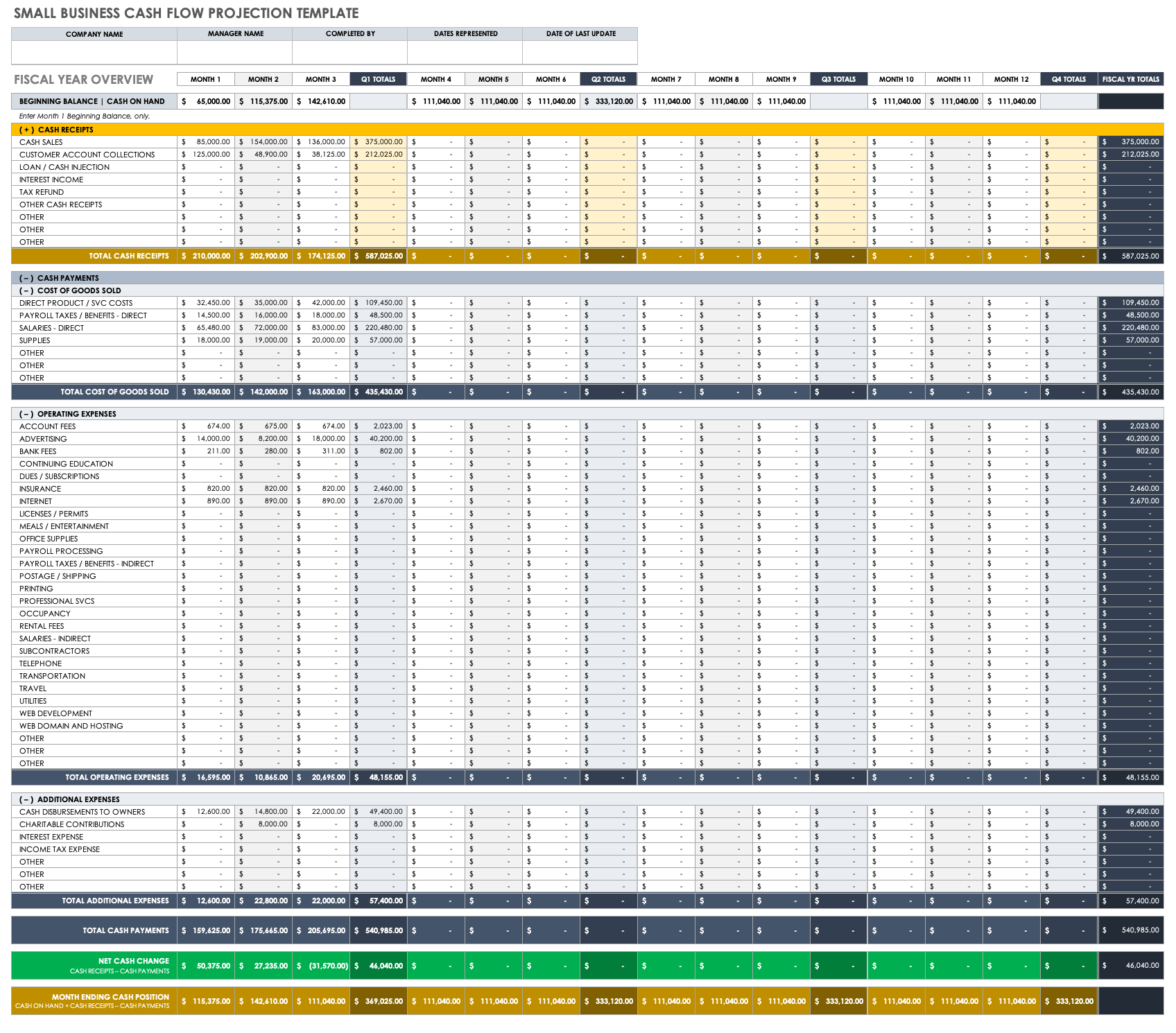

Adapted from a template by Futurpreneur, this resource is ideal for any business needing a practical and efficient way to monitor its cash flow. From corporate tax rates to detailed cash flow forecasts, this template caters to all your financial data needs. It includes placeholders to input past financial data with automatic formulae to calculate growth, costs, EBITDA, and more. It also allows you to predict future sales and growth, along with a robust structure for calculating net working capital.

Accounts Receivable Template

When one has explained the change in each balance sheet line, the accumulated offsets (in the lower portion) reflect the information necessary to prepare a statement of cash flows. This easy-to-use Google Sheets template offers a straightforward layout to track all aspects of cash flow. It starts with the opening balance and then provides space to record monthly cash inflow from various sources, such as contract payment claims, other receipts, and cash sales. In addition, this template provides an in-depth section for calculating Unlevered Beta and Relevered Beta based on the target debt/equity ratio, helping you assess risk more accurately. It also includes a Weighted Average Cost of Capital (WACC) calculation, providing a more comprehensive understanding of a company’s financial health. Vertex42 offers a ready-made cash flow worksheet, breaking down your finances into Operating, Investing and Financing activities.

- Use the quarter-by-quarter tabs to quickly detect any problems with a variety of factors, such as late customer payments and their potential impact on your business.

- The starting balance can be placed at the top or the bottom of the statement.

- They reflect revenue and expenses accrued during a reporting period, including non-cash accounting like depreciation and amortization.

- Basic personal finance is mostly about managing cash flow which means tracking and planning how money is entering and leaving your real and virtual pockets.

- The template allows you to examine your finances in detail, with fields for specific items such as auto maintenance, child care, eating out, groceries, and more.

- The Sheetgo cash flow template is a workflow of connected spreadsheets that exchange data between them.

What To Include In a Cash Flow Template Google Sheets Spreadsheet

Smartsheet offers additional Excel templates for financial management, including business budget templates. Track your company’s overall cash flow with this easily fillable 12-month cash flow forecast template. This template includes unique expected and actual cash-on-hand details for the beginning of each month, which you can use to ensure that you can pay all employees and suppliers. Enter cash receipts and cash paid out figures to determine your end-of-month cash position. The monthly details of this forecast template allow you to track — at a glance — any threats to your company’s cash flow.

Discounted Cash Flow Template

However, the way the two accounting standards classify cash flow activities differs. In our article about income statement you will find a template for income statement for you to download. Cash flow from financing activities can come from receiving financing from investors, issuing payments to shareholders or repaying debt principal.

A standard format cash flow statement uses three main categories to show cash flows in and out of the business. Be vigilant, organized, and tailor your worksheet to your specific needs to maintain an accurate, insightful pulse on your cash flows that guides better decision-making. Maintaining an accurate record of cash inflows and what are t accounts definition and example outflows is vital for the sustainability and growth of your business. The net income line items are also adjusted for changes in the ending and starting balances of current assets, with the exception of cash. Receipts under the direct method include cash collected from customers and cash received from interest and/or dividends.

Similarly, the cash outflow section allows you to select profit and loss accounts and balance sheet accounts to categorize your expenses. You can input estimates and actuals for each account, and the template will calculate the total cash outflow for the week. A Google Sheets Cash Flow Template is a pre-formatted spreadsheet designed to help you track and manage your cash inflows and outflows. Float offers a free cash flow forecasting template to help businesses understand and plan their current financial situation.

The amount of cash or cash equivalents your business needs varies depending on your industry, your objectives, and how much debt you have. However, as a general rule, you should have enough cash or cash equivalents to cover three to six months of business expenses. On the other hand, having too much cash or cash equivalents on hand can be a sign that you’re not taking full advantage of your liquid assets.